Investment Philosophy

As students of the likes of Warren Buffett, Charlie Munger, Seth Klarman, we think of investing as taking part ownership in businesses with a long-term horizon and appropriate margin of safety. We believe in making concentrated investments in 10 to 15 high-conviction quality ideas with a typical horizon of 3 to 5 years. Accordingly, our research process involves spending considerable amount of time in doing deep-dive fundamental research.

Our investment recommendations are guided by three key pillars:

- Management Quality

- Corporate Governance

- Board Composition

- Forensic Accounting and Triangulation

- Balance Sheet Strength

- Operational Efficiency: Historical ROC, Incremental ROC, ROE, DuPont Analysis, Working Capital Analysis

- Industry Analysis

- Competitive Dynamics

- Business Model

- Unit Economics

- Key Performance Indicatiors (KPIs)

- Channel Checks

- Growth Prospects

- Longevity of Moat

- Discounted Cash Flow Modeling

- Replacement Value

- Private/Public Comparable Transactions

- Liquidation Value

- Margin of Safety

- Risk/Reward Asymmetry

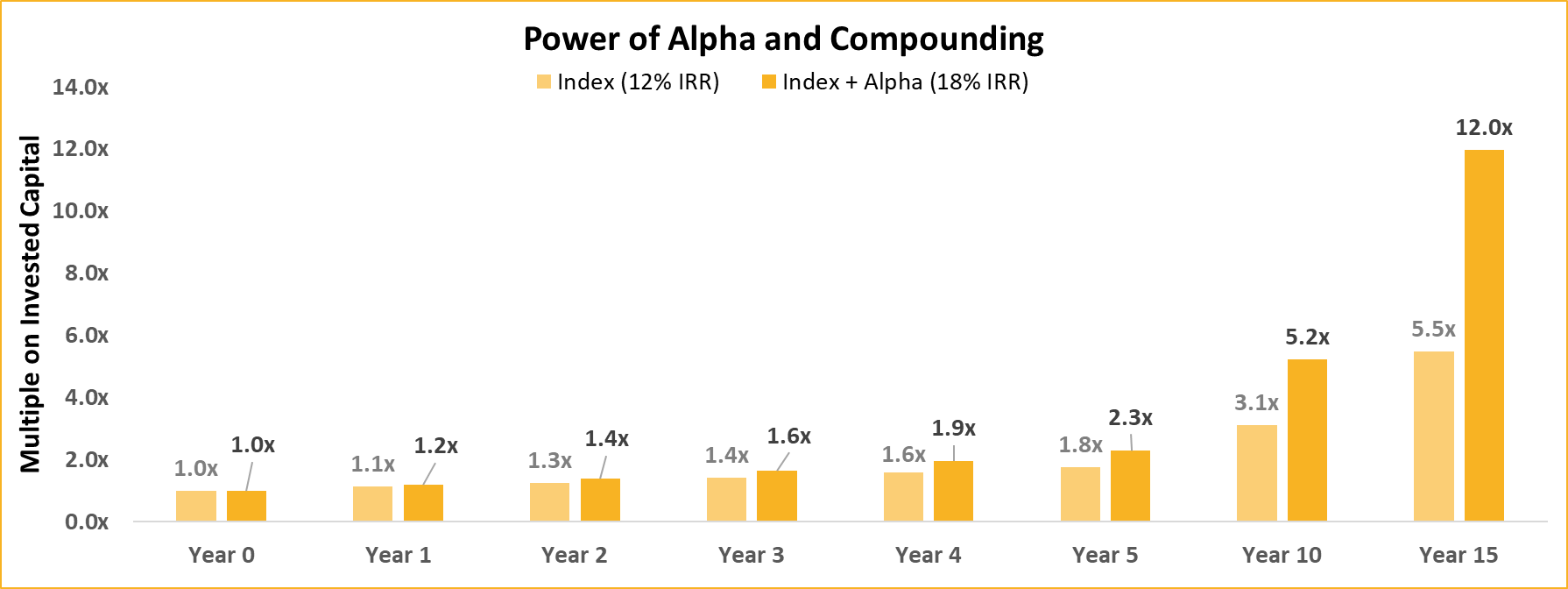

We rely on the power of alpha and compounding to create long-term wealth. An active investment approach (Index + Alpha) with potential for alpha generation (outperformance vs index) can significantly magnify wealth creation vs a passive investment approach (Index ETF) that merely mirrors the index. We strive to generate alpha through our prudent security selection and investment approach. Our long-term horizon enable us to benefit from the Power of Compounding.

Below example demonstrates a return on capital of 12.0x vs 5.5x over a period of 15 years, assuming annualized return (IRR) of 12% for index (in line with historical returns for NIFTY index over period 2004 to 2018) and a projected annualized alpha of 6%. (Note that this example and chart are for illustration purposes and should not be construed as a promise for guaranteed returns).

Reach Out to Us!

Please be free to contact us if you have any further queries.

Disclaimer: Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.