Uniply Industries: More Questions Than Answers?

Disclaimer/Disclosure: This note is just for illustration purposes. The securities quoted are for illustration only and are not recommendatory. Please read our detailed Disclosures and Disclaimer before proceeding further.

Company Background

For quick background, Uniply Industries ("Uniply") is a plywood business that was taken over in mid-2015 by new management under the leadership and ownership of Keshav Kantamneni, a private equity investor. At the time, it continued to be a pure-play plywood business with plans of the new management to grow the branded plywood business multi-fold. Later on in 2016, the company diversified into the interior fittings business through acquisition of a company named Vector Projects ("Vector"). In FY18, the company also initiated some project work in the affordable housing construction space, which has since become a core business for the company.

Summary

A close look at Uniply Industries raises more questions than answers. Its sale of plywood business to an associate company at a potentially discounted valuation raises suspicion. The cash flow movements at Uniply Industries reveal that since the new management took over in 2015, only a part of the investor capital raised has gone into real assets owned by Uniply Industries. Rest of it seems to have been diverted to either promoter’s other business entities, suggesting potential conflicts of interest, or have been consumed for high working capital requirements, suggesting potential weak quality of sales. Recent announcement (as on Jul 3, 2019) around significant stake sale by the current promoter (Keshav Kantamneni) to a Gulf based investment firm raises further suspicion. Why would Keshav sell down his stake from current ~27% to ~7%, when as per management, the firm is on a high growth trajectory, has strong order book and sufficient capital to realize its full potential?

Slump Sale of Plywood Business at a Potentially Discounted Valuation

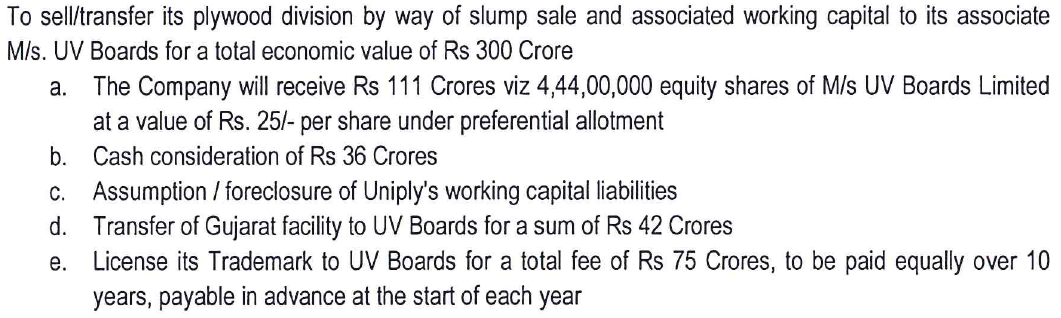

In Aug 2017, Uniply announced a transaction to sale it plywood business to an associate, UV Boards (renamed to "Uniply Decor" post transaction), in exchange for purchase of additional ~29% stake in UV Boards (Uniply already owned ~8%, so post transaction its stake would increase to ~37%) through preferential allotment along with other deal considerations as in the below excerpt.

Excerpt from Uniply's filing for Slump Sale Transaction Announcement

As per our analysis of the economic value of this transaction (not the 300cr economic value quoted by the management as per the above excerpt), it appears that Uniply Industries’ shareholders went from owning 100% of the Plywood business to ~37%, while receiving discounted valuation for the stake sale. Below table details our view of the economic value obtained for the effective 63% stake sale in the plywood business. As per below, the transaction happened at 0.60x EV/FY19Sales (i.e. 94cr EV/155cr FY19 Sales), and at 0.12x EV/PotentialSales (i.e. 94cr EV/750cr potential sales) if one takes the full revenue potential of the Plywood business (>1000cr revenue potential at full capacity, as per management; we are assuming 75% capacity utilization implying 750cr revenue potential). This compares to a valuation of 2x EV/FY19Sales for Greenply and CenturyPly around Aug 2017 when this slump sale transaction was announced. Note that we have used FY19 sales in our valuation as FY18 sales was transitory in nature given the transaction was consummated only towards the 2H of FY18.

| What are Uniply Industries' Shareholders Getting? | Value (Cr) | Comments | What are Uniply Industries' Shareholders Gving Away? | Value (Cr) | Comments |

|---|---|---|---|---|---|

| Direct Cash | 36 | Direct cash component of the deal | Cash for buying equity stake in post-transaction UV Boards | 111 | Cash outflow to purchase additional stake of ~29% in post-transaction Uniply Decor |

| Cash for Gujarat facility | 42 | Sale for Gujarat facility | 63% stake in Uniply's erstwhile Plywood Assets(Plug) | 59 | Calculated as plug, suggesting just 59cr value of 63% stake implying EV of 94cr for the whole Uniply Industries' erstwhile plywood bussiness. This sugeests that the transaction happened at 0.60x EV/ FY19Sales, and at 0.12x EV/ PotentialSales if one takes the full revenue potential of the plywood bussiness (>1000cr revenue potential at full capacity, as per management, we are assuming 75% capacity utilization implying 750cr revenue potential) vs EV/ sales of 2x for Greenply around Aug 2017 when the slump sale was announced. |

| Increased stake of 29%(37% from 8%) in pre-transaction UV Boards | 10 | Valuing at 2.2x EV/ Sales implies 39cr EV and 33cr Equity value, suggesting approximate 10cr value for 29% equity stake. 2.2x EV/ Sales is similar to Greenply's valuation at the time of transaction which is afavourable assumption for Uv Boards given limited brand recall for standalone UV Boards vs strong recall for Greenply's brand. | |||

| Transfer of Net Working Capital Liabilities | 36 | Transfer to UV Boards post transaction | |||

| Royalty Present Value | 46 | 75cr royalty spread over 10 years and is discounted at a rate of 10% | |||

| Total | 170 | Total | 170 |

Another way to attest our above hypothesis on discounted valuation is, how come the 37% stake in the post-transaction UV Boards business was valued at 111cr when 63% of Uniply Industries’ erstwhile plywood business was valued at just 58cr, despite post-transaction UV Boards business comprising primarily of Uniply Industries’ erstwhile plywood business? High quantum of goodwill (81cr) recorded by post-transaction UV Boards relative to fixed assets of 39cr (post transaction), further attest the high premium paid by Uniply for increased stake in the post-transaction UV Boards entity, implying discounted valuation for the stake sale in plywood business of Uniply.

Suspicious Cash Flow Trail at Uniply Industries

The cash flow movements at Uniply Industries reveal that since the new management took over, only a part of the investor capital raised has gone into real assets owned by Uniply Industries. Rest of it has been diverted to either promoter’s other business entities, suggesting potential conflicts of interest, or have been consumed for high working capital requirements, potentially suggesting weak quality of sales.

Over the past four years through FY18, management has raised 615cr, 335cr from issuance of equity/warrants and the rest 280cr (split as 57.5cr: long-term + 160.5cr: short-term + 62.6cr: debentures) from debt. Below is a summary of Uniply Industries’ proceeds and use of capital over the past four years.

| Proceeds of Capital | FY15 | FY16 | FY17 | FY18 | Total |

|---|---|---|---|---|---|

| CFO ex Working Capital Movement | 11.1 | 15.3 | 30.8 | 60.3 | 117.5 |

| Working Capital Changes | 25.5 | 25.5 | |||

| Interest and Dividend Received | 0.1 | 0.1 | 12.5 | 2.5 | 15.2 |

| Net Fixed Assets Sold | 8.3 | 8.3 | |||

| Equity Raise | 26.7 | 75.9 | 232.3 | 334.9 | |

| LT Borrowing | 6.7 | 50.8 | 57.5 | ||

| ST Borrowing | 104.6 | 55.9 | 160.5 | ||

| Debentures | 62.6 | 62.6 | |||

| Investments Sold | 0.0 | ||||

| Cash Depletion | 0.9 | 59.1 | 60.0 | ||

| Total | 18.7 | 42.1 | 337.1 | 443.9 | 841.9 |

| Uses of Capital | FY15 | FY16 | FY17 | FY18 | Total |

|---|---|---|---|---|---|

| CFO ex Working Capital Movement | 0.0 | ||||

| Working Capital Changes | -9.2 | -29.4 | -153.3 | -191.9 | |

| Net Fixed Assets Bought | -0.4 | -0.4 | -56.5 | -57.2 | |

| Equity Bought | -0.2 | -0.2 | |||

| Int Paid | -8.9 | -7.5 | -12.0 | -29.1 | -57.6 |

| LT Borrowing | -3.3 | -8.7 | -12.1 | ||

| ST Borrowing | -0.9 | -0.9 | |||

| Investments Purchased | -1.9 | -102.3 | -104.1 | ||

| Loans Given | -30.2 | -303.8 | -334.0 | ||

| cash Addition | -0.7 | -83.3 | -84.0 | ||

| Total | -18.7 | -42.1 | -337.1 | -443.9 | -841.9 |

As the Uses of Capital table above reveals, the two big-ticket items where the capital has been used are “Loans Given” and “Working Capital”. Let us take a closer look at each of them.

-

Loans Given: Bulk of the 334cr loans given has been funneled to other promoter entities like Foundation Outsourcing India Pvt Ltd “FOIPL” (name changed to KKN Holdings – holding company for Keshav’s investments) and Foundation Outsourcing Pvt Ltd (seems to be an offshore entity as no MCA records available for it) in the name of capital advances. Going by FOIPL’s website, it is an investment holding company with ownership in Uniply Industries (and subsidiaries like Vector, Uniply Blaze), ArtMatrix Malaysia, ETA Techno Park SEZ and Forge Point. It appears (not verified) that the capital advances made to FOIPL have gone into acquisition of 40% stake in Art Matrix, other investments like ETA Techno Park SEZ, etc. with the promoter entities gaining beneficial ownership in these companies at the expense of Uniply Industries’ shareholders.

ArtMatrix Malaysia Investment: As per FOIPL’s website, FOIPL owns 40% in ArtMatrix Malaysia (a Malaysia based interior design and furniture company). While the transaction date for this is not known, Uniply Industries came out with a public announcement in Jan 2018 revealing intention to buy 100% stake in ArtMatrix Malaysia and a related proposal to raise ~200cr via equity capital. Later in Feb 2018, when the actual capital raising proposal was announced by Uniply Industries, it was not just the ~200cr capital stated above but also included plans for raising additional capital of ~400cr through warrants, so all in the plan was for raising ~600cr of capital suggesting an equity dilution of ~60%, assuming all warrants are exercised within their stipulated tenure of 18 months. There was no specific mention of the purpose of this 400cr capital raise. While Uniply Industries went ahead and executed its capital raising of 600cr by Apr 2018, since then it has gone completely silent on its plans to acquire Art Matrix. It has been over a year now and there has been no communication on how the raised capital is being used. On the other hand, promoter entity FOIPL’s 40% stake in Art Matrix Malaysia raises suspicion around management’s intention, potential conflicts of interest and potential funding of the stake via the capital raised from Uniply Industries’ shareholders.

- High Incremental Working Capital: Other big chunk of cash outflow for Uniply Industries has been the incremental working capital. Since end of FY14 to end of FY18, Uniply Industries has clocked cumulative incremental sales of 275cr during FY15-18 requiring incremental working capital of 165cr, which implies 60% of sales i.e. approx. 215 days. As per management, this is largely due to the Vector business. Going by average order book size of 85cr for Vector (rough estimate based on order book of 60cr as on Apr 1, 2017 and 110cr as on Apr 1, 2018 per FY18 annual report), an approximate estimate for project timeline would be about 135 days (365 * FY18 Sales of 320cr/Avg Order Book Size of 85cr). The working capital requirement of 215 days appears to be high relative to the average estimated project timeline of about 135 days.

All in all, of the 615cr capital raised, direct investments for Uniply Industries have been only 318cr split as:

- Net investments of 49cr in fixed assets: Purchase of 57cr of fixed assets, offset partially by sale of 8cr of fixed assets

- 84cr investments (net of goodwill): 104cr cash outflow (refer to the “Uses of Cash” table) towards investments purchased. Of these investments, Uniply Decor has goodwill of 81cr, which adjusted for 37% stake is 30cr. Deducting this 30cr from 104cr, gives us 84cr.

- Incremental working capital of 165cr as discussed above

Were it not for the loans given, these 318cr investments could have been potentially funded by internal accruals of >100cr as indicated by cashflow from operations ex working capital (adjusted for other miscellaneous cash outflows) over FY15-18 and some additional funding (~200cr) via debt/equity vs current capital raise of 615cr. Why did the company raise so much capital despite the management’s claim in its FY18 Annual report that “The Company does not expect to make any significant capex across the foreseeable future”? The 615cr capital raise through FY18 does not even include the 300cr of capital expected to flow from convertible warrants during FY19/FY20 (note that about 200cr of warrants were already exercised in Oct 2018 i.e. during FY19, so only 100cr worth of warrants now remain unexercised). Despite all this capital raise and a significant chunk of business now coming from asset light and working capital light (as per management) construction business, why does the company continue to carry >300cr debt as of end of FY19 (176cr of which is long-term and has increased from 104cr at the end of FY18)?

Does management's Actual Execution match its Tall Claims?

De-growth in Plywood’s B2C Business: Uniply’s B2C business seems to have de-grown significantly from the time it was acquired despite management's claims that the Plywood business has strong growth potential. At the time of acquisition in 2015, Uniply TTM sales were about 170cr. As of end of FY19, excluding sales to Vector which is a B2B business, plywood business’ B2C revenues were <100cr, significantly lower than that in 2015. This is in line with my channel checks regarding Uniply’s on-ground presence. To get a sense of the distribution network of Uniply, I called 25+ dealers across key markets for Uniply like Chennai, Chandigarh and Ahmedabad. <10% of these dealers carried Uniply brand and some of them did not even recognize the brand. Of the few dealers that carried Uniply, they also carried other renowned brands such as Greenply, Centuryply, etc. Further conversations with these dealers revealed that Uniply has no particular competitive advantage over other brands. Many other branded plywood companies are also offering termite-proof, water-resistant properties along with 20+ year guarantees.

De-growth in Vector’s Business: Going by FY19 results, Vector’s interiors business revenues declined to <270cr in FY19 vs about 320cr in FY18, despite management's strong expectations from this business.

Weak Brand Advertisement: Actual advertisement expenditure has been nominal relative to the 4-5% of sales guidance provided by Keshav back in 2015. Advertisement expenses were <17 lakhs in FY18 (<0.2% of plywood sales), despite a seemingly high and annually recurring (for 10 years) royalty fee of 7.5cr charged to Uniply Decor (3.75cr of which was paid for 2HFY18). In FY17, advertisement expenses were as low as <4 lakhs.

Reach Out to Us!

Please be free to contact us if you have any further queries.

Disclaimer: Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

We would appreciate your valuable feedback! Please leave us your comments below.