Jenburkt Pharma: A Hidden Gem and a Steady Growth Compounder

Disclaimer/Disclosure: This note is just for illustration purposes. The securities quoted are for illustration only and are not recommendatory. Note that the author of this note may have vested interest in the stock. Please read our detailed Disclosures and Disclaimer before proceeding further.

Investment Thesis

- Jenburkt Pharma is an INR 240cr branded generic pharma company, with >85% revenues coming from domestic sales. It is effectively a play on domestic pharma, that over the past decade has grown at >10% CAGR and is likely to continue to do so backed by many tailwinds for the industry.

- While there are many different business models in the domestic pharma industry, Jenburkt in our view is best classified as an “Access Drivers” player (refer to later sections of the report for more information).

- Jenburkt’s key strengths - strong product portfolio, robust distribution and brand recognition – makes it a strong competitor among its “Access Drivers” peers.

- Jenburkt’s key moats are its 1) brand’s quality perception (determined based on our channel checks with specialist doctors and pharmacists) 2) strong distribution channel spanning across tier I to tier IV cities and 3) new product launches on a regular basis to extend key popular brands (via new dosage forms and drug combinations) and strengthen its portfolio in fast growing therapies.

- With a strong track record of successfully launching new products and brand promotion, Jenburkt has consistently milked its distribution channel well, posting 10-12% revenue CAGR over the past decade.

- Its measured growth approach funded fully through internal accruals, coupled with 25%+ ROEs enables it to generate strong FCF that has been distributed consistently to shareholders through dividends and buyback.

- We think it is a hidden gem due to its low liquidity and BSE only listing.

- Its attractive valuation at 11x TTM PE (adjusted for cash), growth prospects and FCF yield, makes it an ideal candidate for compounding 15-20% IRR over the medium-term to long-term holding period.

Domestic Pharma Industry Growth

Within Pharma, we have been largely avoiding US focused pharma players given the heightening competition from increased number of generic players and increased pace of generic approvals, vertical integration among distributors leading to increased bargaining power of customers and heightened scrutiny from FDA. On the other hand, we believe domestic pharma (domestic drugs consumption i.e. not excluding exports) is a strong secular growth story backed by many tailwinds supporting its growth prospects.

Domestic pharma industry (also referred to as IPM – “Indian Pharmaceutical Market” in this report) has been growing at >10% CAGR over the past decade and is likely to continue to do so given the large untapped demand in India. Domestic pharma industry is as large as $17bn currently. Increasing healthcare awareness, push from government, increasing insurance and hospital penetration, increasing incidence of lifestyle diseases are all likely to continue to provide impetus to the domestic pharma industry for continued growth. Our view is that drugs spending growth in India is likely to exceed nominal GDP growth which is expected to be in the 8-12% range annually over the next 3 to 5 years. Backed by various tailwinds highlighted before, we estimate potential for growth in Indian pharmaceutical market (IPM) to be at least 10% annualized for the next decade. We further believe that Jenburkt will likely outperform industry growth through its prudent strategy and competitive positioning.

Within the generics space, branded generics constitute 90% of the market. Branded generic formulations represent 100% of Jenburkt’s revenues. Our channel checks suggest that branded generics will continue to be favored by doctors/pharmacists due to their reliability and efficacy. Prevalence of fraud in India inhibits trust in unbranded generics and accordingly we don’t expect unbranded players to gain meaningful market share despite government push.

How does Jenburkt Pharma Stack Up relative to the Industry?

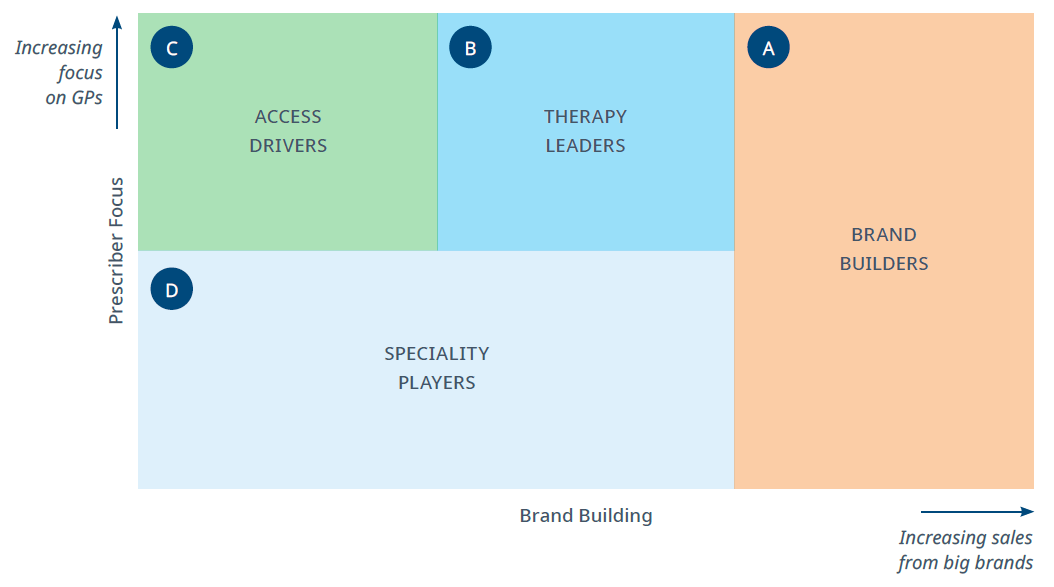

While the domestic pharma industry is quite competitive, the strong growth prospects and varied business strategies, ensure space for many players to co-exist. As per an IQVIA analysis, the Indian Pharmaceutical Market (IPM) can broadly be categorized into 4 categories based on the prescriber and brand building focus of the various pharmaceutical companies operating in the Indian market.

“Brand Builders” segment is typically dominated by large players that use their legacy mega brands (top brands do annual sales as high as 500-600cr) to drive their business model in India. “Therapy Leaders” are again large players, albeit focused on a few core therapies served through multiple mid-large sized brands (5-10 brands with each doing annual sales of >INR 50cr). The third category comprises of “Access Drivers” that rely on the strength of their distribution network, select product and geographic positioning to drive growth and profitability. Finally, the space comprises of the “Specialty Players” that target chronic and niche therapies led by specialty innovator products.

Jenburkt ranks among the top 130 pharma companies in the domestic pharma industry as per MAT (Moving Annual Total) sales. Based on its business strategy and market positioning, it is best classified as an “Access Drivers” player. Its wide-reaching geographic distribution and large sales force coupled with a good brand recall makes it a strong competitor among its “Access Drivers” peer group.

Sound Business Model

Business model for an “Access Drivers” players is akin to that of a branded retailer. Strong distribution, prudent product positioning and wide geographic reach (tier I to tier IV cities) and strong brand are key performance indicators driving success of any company in this segment.

Jenburkt has a strong moat in all these areas making it a high-quality player in its segment.

- Robust Distribution Network: Jenburkt has a strong distribution channel that covers many physicians and chemists, with distribution spanning across tier I to tier IV cities. To provide some context around the distribution strength of Jenburkt, let us compare its distribution network with that of a similar peer, Unison Pharmaceuticals.

- Both Unison and Jenburkt feature in 100-130 rank segment as per IQVIA MAT sales analysis. Unison focuses mostly in Gujarat while Jenburkt has a wider pan-India approach with a focus on the Western and the Central region. Both Unison and Jenburkt follow the “Access Drivers” business model. Unison competes on price while Jenburkt competes on its distribution strength. Relative to Unison, Jenburkt has a much stronger sales and distribution channel with sales force comprising of 575 representatives across India covering 75,000 doctors and 50,000 chemists supported by a distribution network of 1,000 stockists and 25 super-stockists. Compared to this, Unison has a sales force of just 270 representatives and 120 stockists. Our channel checks suggest that pricing is not a key determinant of decision making in the pharma supply chain as neither the prescriber nor the chemist is incentivized to prescribe a lower priced product. In fact, higher pricing is perceived as higher quality limiting prescriber’s liability risks and incentivizes the distribution channel (chemist, stockists) better through higher margins. Accordingly, while Unison has a decent business model through its low pricing strategy, we think Jenburkt’s focus on distribution strength and quality branding lends itself a far superior business model and growth potential.

- Appropriate Product Positioning:

- Acute vs Chronic: For an “Access Drivers” player to do well, it is important to have a good acute-therapy based portfolio. The acute segment tends to be a higher turnover segment and enables the pharma companies to maintain good relationships with doctors and the supply chain. At the same time, a good chronic portfolio is also essential to bolster growth and remain competitive. Jenburkt’s product mix and sales are well balanced with 70% revenues coming from acute and rest 30% from chronic.

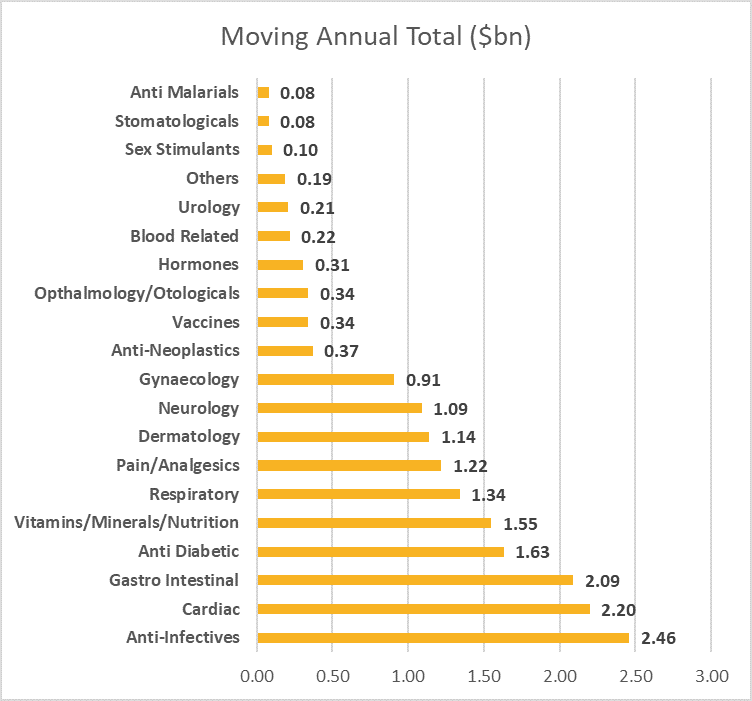

- Jenburkt’s products have a strong representation in 8 of the top 10 largest therapies in the IPM. These 10 therapies in aggregate constitute 70% of the IPM market. Many of these therapies have been also been witnessing strong double-digit and high-teens growth.

![blog img]() Source: MedicinMan January 2018, IBEF

Note: Data is as of Dec 2017

Source: MedicinMan January 2018, IBEF

Note: Data is as of Dec 2017

Top 10 Therapies Jenburkt's Brands Anti-Infectives Triben, Numox, Ojen, Eberjen, Lutriben, Lulihen, Itriben Cardiac NA Gastro Intestinal Zix, Rabera, Rabega, Mobitide Anti-Diabetic Metmin, Glucotrol Vitamins, Minerals & Nutrition Topcal, Nervijen, Aminoglobin, Preglac, Zenglobin, Ecoprot Respiratory Piritexyl, Piril, Efelac, RT Cure, Allerzine Pain/Analgesics Cartisafe, Zix, Powergesic, Lorpijen, Zydol, Trapidol, Jencer Dermatology Triben, Ojen, Eberjen, Lutriben Neurology Nervijen Gynaecology NA Note: Brands in bold font are leading brands for Jenburkt in the respective therapy segment

- Jenburkt’s key drugs such as Nervijen, Powergesic, Piritexyl, Topcal, Triben, Ojen, Lorpijen, Numox, Zix, Cartisafe, Metmin, etc. have a strong brand recall among doctors and stack up well in terms of competition, as per our channel checks with specialist doctors and pharmacists. Pricing-wise, most of Jenburkt’s product tend to be in the middle of the pack, but in most cases, the lower-priced competitors are not as renowned as Jenburkt. See below, a competition matrix we put together for key products of Jenburkt. In terms of pricing strategy, our channel checks with doctors and chemists suggest that it is best to price the product in the middle as it ensures good channel margins across the supply chain, evokes high quality perception while staying away from the perception of exorbitant pricing. This leads us to believe that Jenburkt’s pricing strategy is prudent. Based on below assessment, we believe that

while each of Jenburkt’s key brands face significant competition, Jenburkt has been able to carve out certain niches where competition is limited.

Key Brands Competitive Intensity Triben Presence of big brands like Lupin, Sun, Zydus, Mankind. However, Jenburkt's brand recall and price competitiveness is strong in the 30ml lotion category. Numox Some Jenburkt's combinations like Numox 250 has only 5-6 same combination competitor products, of which only Cipla and Ranbaxy are renowned brands. Others have limited direct competition, except in one combination where Alkem is a direct competitor. Ojen 50-100 competitor products; Jenburkt's product pricing is mostly middle of the pack thus not exorbitantly high but enough to ensure good channel margins and quality perception. Topcal Highly competitive, although one of the combinations have limited direct competition. Nervijen Many of its variants/fixed dose combinations have zero to limited direct competition. Cartisafe Most Jenburkt's combinators have strong pricing advantage relative to competition; in some combinations, there is none to limited direct competition. Zix Highly competitive; Jenburkt has 8 or more combinations, of which about couple have limited direct competition. Starting FY20, the company has launched a new division “BRENZ” to gain market share in the competitive Pain/Analgesics and Gastro Intestinal space through Zix brand. It has assigned dedicated sales force of 60 representatives. Powergesic Highly competitive except for one combination where there is no direct competition; also launched in spray form recently which helps in differentiating from the competition and is a higher margin product. Piritexyl Highly competitive 60ml segment; limited competition in the 100ml segment. Metmin Metmin500 faces lot of competition and is also in the NLEM list so prices are capped, however MetminA is an indigenously developed unique combination with no direct competition. Source: Pricing data has been web-scrapped from medplusmart.com

Scaling up via three-pronged growth strategy - Product, Brand and Distribution

Jenburkt’s management has a strong track record in taking growth initiatives across key growth drivers like new product launches, brand building and milking distribution.

| Fiscal Year | New Launches |

|---|---|

| FY 2009 | Zix SR, Zix MR-8, Lorpijen and Numox CV - have done well to become key brands for Jenburkt over the years |

| FY 2010 | Ojen Eye & Ear Drops, Triben Plus Ear Drops - Both Ojen and Triben have become strong brands in the Anti-Infectives space |

| FY 2011 | MetminA (difficult formulation and Jenburkt was among the early innovators as per the management), Cobalamine and Citicholie with Vitamins |

| FY 2012 | New Products in Diabetology, Arthritis and Nutrition |

| FY 2013 | New Nutrition Products |

| FY 2014 | Hypovit, Frendacid (commercialization), Started operations in Tajikstan and Uganda |

| FY 2015 | Expanded to Ivory Coast but progress hampered by Ebola |

| FY 2017 | Senna (International), Vitamin-D chewable tablets and drops for international markets, Itraconazole 100 and 200 mg capsules, Cough expectorants with a broncho dilater for adults and kids |

| FY 2018 | Triben and Triben B Spray, Eberjen and Eberjen M Cream, Powergesic Spray, Powergesic Plus Spray, Zix Balm, Lutriben Cream and Spray, New Piritexyl Syrup - Of these, 4 have been new dermatology products; industry consultant, IQVIA, highlighted dermatology as Jenburkt's key growth area; launch of spray, cream, gel forms of existing strong brands help in improving market share and profitability |

| FY 2019 | Launched Oxicojen cream and lotion in Dermatology segment and Powergesic 2X Gel in the Orthopedic segment towards the end of fiscal year |

Building Brand and Awareness: Jenburkt’s management has consistently taken several initiatives to promote its brand. Some examples of such branding initiatives are highlighted below.

| Type | Initiatives |

|---|---|

| Medical Camps |

|

| Doctor Events |

|

| Corporate Brand Building |

|

Milking Distribution: Jenburkt’s leverages its robust distribution network well through new product launches and branding initiatives. Its channel partners enjoy strong growth, incentivizing them to stick with Jenburkt through the thick and the thin. This is one of the key reasons behind Jenburkt’s strong historical performance, especially during tough times for the industry. Jenburkt also has an exports business which currently is less than 15% of revenues focused on emerging and frontier markets areas in Africa, etc. where the untapped demand is huge. Jenburkt exports to about 15 countries and regularly registers new products with international authorities in these countries.

Shareholder Friendly Management with Good Capital Allocation Discipline

Jenburkt has consistently returned excess cash flow through regular dividend payout (25-30% of earnings) and recent buyback. All the growth is funded through internal accruals, with limited to no use of debt.

Other Checks

Our checks on quality of operations, management and corporate governance, as below, show decent performance.

| Cateogory | Comments |

|---|---|

| Operational Efficiency | Strong ROE of 25%+ (Last 5Y Avg has been ~29%); Working capital management has been somewhat volatile over the last 5Y, albeit rangebound and mean reverting |

| Management Quality | Management has a strong track record of execution as proven by the consistent scaling up and growth of the business. Good capital allocation discipline and shareholder friendly approach as highlighted earlier is further comforting. |

| Corporate Governance | Organization structure is plain and simple with no unnecessary subsidiaries. Promoter shareholding over the past many years has only increased with ownership largely through individual ownership (again no unnecessary holding companies). Loans and advances are minimal. No material related party transactions of concern. Good internal controls as validated by its award receiving cost accounting practices. Some Areas to Watch:

|

Why is it a Hidden Gem?

Lack of Liquidity: Jenburkt’s BSE only listing limits the liquidity in the stock, keeping away participation from institutions and the larger investor community.

Faster Growing Peers: While Jenburkt’s revenues has grown at a healthy pace of ~10-12% CAGR over the past decade, many of its peers have scaled up their businesses much faster through exports-oriented and acquisition-led strategy. While we would love every inch of growth as an equity investor, we appreciate the measured growth approach of the management with a focus on domestic markets and select peripheral emerging/frontier markets. The past few years have shown how high-flying markets such as US can witness declining growth from heightened competition despite the large potential of the market.

Path to Value Realizatio

Medium-term Catalysts

- Consistent delivery on growth through new product launches, improving product mix (high value dosage forms and therapy mix), milking of its distribution network and growth from industry tailwinds

- Attention from Institutional Investors – Government of Singapore established a >2% shareholding in the company over the past couple of years

Far-sighted Wishful Catalysts

- Possible NSE listing – Large institutions and MFs likely to follow once enough liquidity is available

- M&A Optionality: Could be a good candidate for acquisition by a bigger pharma company given Jenburkt’s strong brand, distribution network and product portfolio

Key Risk Factors to Watch

Below are some of the key risk factors to watch, when investing in Jenburkt.

| Cateogory | Comments |

|---|---|

| Regulatory Risks | Government Push for the usage of Unbranded Generics: This seems to be the biggest overhang on the domestic pharma industry currently. However as discussed earlier in the report, we don’t expect unbranded generics to take a material market share away from branded generics due to their low-quality perception and high susceptibility of fraudulent behavior in India. India lacks the necessary quality framework and testing infrastructure to pursue a broad stroke blatant unbranded generics strategy. As an example, Government’s own efforts to procure unbranded generic drugs for their own internal agencies have been lackluster. Nonetheless, if for some reason, government is hellbent on mandating doctors to prescribe only unbranded generic drugs or pressuring pharmacists to do so, Jenburkt’s revenues would be severely affected and can materially affect our positive outlook on Jenburkt as an investment. Pricing Pressure: DPCO price controls on select drugs or through classification of certain drugs as essential medicine through NLEM. While it is hard to predict any such future rulings and its impact, recent government intervention to limit NPPA activities has been a big positive and has curtailed pricing pressure risks significantly. Ban on Select Drugs: NPPA regularly bans certain fixed-dose combinations (FDC), that appear irrational. In the past, this has not been a big dampener for Jenburkt, suggesting that the management has been prudent in selecting value-additive drug combinations. |

| Competitive Dynamics | Branded Generics space in India is highly competitive with presence of many high-quality companies. Competition is further intensifying as new companies are entering the market and as global established companies are increasing focus towards India. We think competition is here to stay and is only going to increase. However, strong growth tailwinds in the sector and robust competitive positioning of Jenburkt relative to its peers is comforting. |

Reach Out to Us!

Please be free to contact us if you have any further queries.

Disclaimer: Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

Source: MedicinMan January 2018, IBEF

Note: Data is as of Dec 2017

Source: MedicinMan January 2018, IBEF

Note: Data is as of Dec 2017

We would appreciate your valuable feedback! Please leave us your comments below.