CESC Ventures: A Free Option on a Fast-Growing Ambitious FMCG Business!

Disclaimer/Disclosure: This note is just for illustration purposes. The securities quoted are for illustration only and are not recommendatory. Note that the author of this note may have vested interest in the stock. Please read our detailed Disclosures and Disclaimer before proceeding further.

Investment Thesis

CESC Ventures is a diversified business with interests across 1) a relatively new-born fast-growing FMCG business, 2) IT-BPO services, 3) real estate (predominantly Kolkata Mall) and 4) restaurants. In our investment approach, we tend to find investments that present asymmetric risk/reward proposition i.e. Heads I win, Tails I don’t lose much. CESC Ventures is one such idea. At current valuations, CESC ventures offers robust margin of safety, while providing strong upside potential if its FMCG business fructifies as planned.

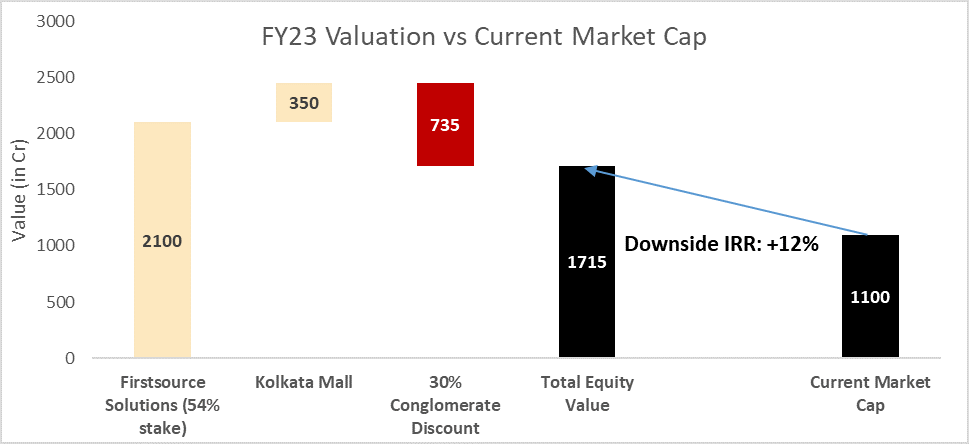

Robust Margin of Safety (Downside IRR: +12%): CESC Ventures is present in IT BPO services business through its ~54% stake in Firstsource Solutions. Its equity stake in Firstsource can be conservatively valued at 2100cr (100% stake valued at 3900cr), 4 years forward from now. Secondly, CESC Ventures owns a Kolkata based luxury mall named “Quest Mall” that spans across 4,15,000 sq ft of leasable area and can be conservatively valued at 350cr (equity value) by FY23. With conglomerate discount of 30%, together these assets can be valued at 1715cr, providing enough margin of safety, over the current market cap of 1100cr, with implied downside IRR (annualized return) of +12% over four years.

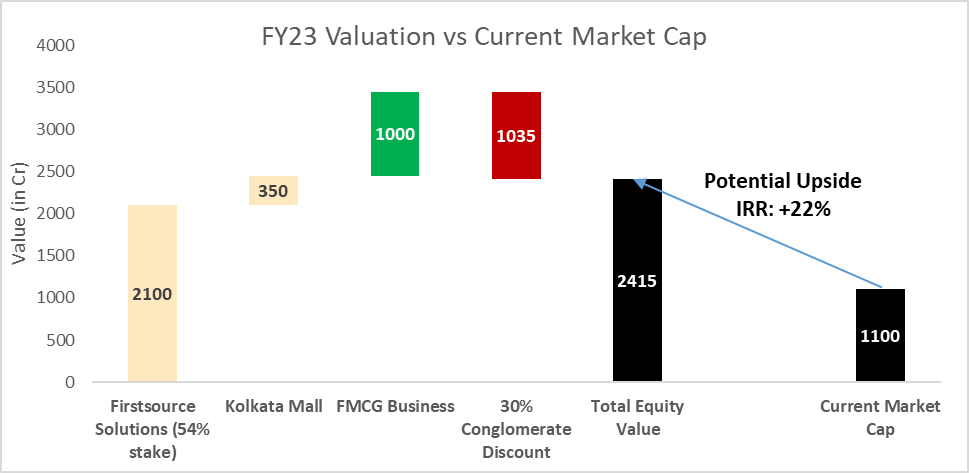

Strong Upside Potential (Upside IRR: +22%): The new-born fast-growing FMCG business has tremendous potential. With 2% market share already in a highly competitive Western snacks market within just 2 years of launch, CESC Ventures has made its mark and is heading in the right direction. Led by bold and visionary, Sanjiv Goenka, and under able leadership of ex McKinsey consultant, Suhail Sameer, CESC Ventures has plans to grow the food segment of its FMCG business to as large as 2000cr+ in terms of sales over the next 1-2 years. Its plans for the broader FMCG business are much more ambitious with plans to clock 10,000cr+ sales with forays into personal care, possibly beverages and other adjacencies. Note that our projections are much more conservative and assume CESC Ventures will clock revenues of 1500cr+ from FMCG (including both food & non-food) business by FY23 (i.e. over 4 years). With conservative valuation of 1x EV to Sales, CESC Ventures’ FMCG business can be reasonably expected to grow over the next 4 years to EV of 1500cr+ implying 1000cr+ equity valuation (assuming net debt/equity dilution of 500cr by FY23 – note that current net debt levels are negligible).

A quick sum-of-the-parts valuation (as in the below chart) suggest that the company can command a valuation of >2400cr over the next 4 years, if its FMCG business progresses as planned. This implies that the stock has potential to provide +22% IRR (annualized return) over the next 4 years.

Note that the above valuation is while making conservative assumptions:

- Assumes 1500cr revenues for FMCG business over the next 4 years vs 2000cr revenues projected by the management over the next 1-2 years

- Discounts significantly the 10000cr revenues projected by management across food, personal care and other FMCG segments over the next 3-5 years

- Conservative growth assumptions of 5% for FirstSource Solutions and 4% for Kolkata Mall

- Zero valuation for the restaurant business, Haldia residential real estate project and the utilities focused IT business of the standalone entity

Before taking a deeper dive into each of CESC Ventures’ businesses, let us spend some time in understanding the quality of management i.e. the visionary and bold promoter, Sanjiv Goenka, who is going to be the lynchpin driver of growth for CESC Ventures in the coming years.

Bold and Visionary Leadership of Sanjiv Goenka

As equity owners, we like promoters and management teams that have fire in the belly to grow and scale businesses while ensuring attractive return on capital and profitability. Sanjiv Goenka, is one such promoter, who has zero tolerance for inefficiency and complacency. This is best exemplified by Sanjiv Goenka’s achievements and execution since he launched out on his own (as RP-SG Group) in 2010 post amicable split of the RP Goenka group. Despite various struggling businesses in his stable at the time, Sanjiv Goenka has since surpassed all expectations by turning around these businesses brilliantly and in the process has created significant wealth for its shareholders. Sanjiv Goenka’s leadership style hinges around people. He is a big believer in hiring the right people and setting the right culture. His achievements have largely been a function of taking bold decisions around firing the inefficient, complacent and slow, despite initial resistance, and replacing them with the best and the brightest. Below table summarizes the turnaround achieved by Sanjiv Goenka in various of his businesses.

| Company | Turnaround Steps Taken by Sanjiv Goenka |

|---|---|

| Phillips Carbon |

|

| Saregama India |

|

| Firstsource Solutions |

|

| CESC |

|

On the other hand, Sanjiv Goenka has had his share of failure with Spencer Retail which expanded too widely and quickly and later had to be downsized both in terms of size and count of individual stores so as to rationalize the balance sheet. However, despite these hiccups, Sajniv Goenka has stayed the course and has recently been able to turn around Spencer Retail both from a profitability and a growth perspective. Spencer Retail is currently led by Shashwat Goenka, under the close guidance of his father, Sanjiv Goenka.

Guiltfree Industries – FMCG Business

CESC Ventures ventured into FMCG business with the launch of its Too Yumm! brand back in April 2017. In just two years, its FMCG food segment has grown to capture 2% market share in the highly competitive Western snacks segment. This is a rare feat as it takes years and years to build a FMCG brand and distribution. For context, Prataap snacks took about 7 years to reach 4% market share in the western snacks category from 1% before. Right branding, robust distribution and a differentiated product positioning are key to the success of CESC Ventures. Its numerous awards around food innovation, brand campaign and packaging are a further testimony to this.

Brand: For any new FMCG business, the toughest challenge is to establish its brand. Too Yumm! has done a great job at building its brand. Roping in Lintas for its media campaigns and hiring fitness icon Virat Kohli as brand ambassador has helped Too Yumm! in spreading its awareness. The product name “Too Yumm!” emphasis on taste while its campaign around “Baked not Fried” and “Guilt Free – Fikar Not” messaging evokes healthy value proposition and has worked well in capturing consumer’s attention. Its attractive packaging as below has further helped in brand perception.

Differentiated and Appropriate Product Positioning: CESC Ventures has done significant R&D to come up with the right localized flavors and product portfolio. When it comes to snacking, taste remains paramount for Indian consumers. Health, although important, is secondary. Through its product innovation and R&D, Too Yumm! has been able to launch products that are both tasty and healthy. Too Yumm! began its journey with the launch of attractive flavors in niche product categories that had limited competition such as Foxnuts, Multi-grain chips, Veggie Stix and later as its brand became more established, it expanded into more competitive space Karare (like Kurkure in shape and size). Note that Riblon/Gathia (read Kurkure) is one of the biggest sub-segments in the Western Snacks category and management claims that Too Yumm! has potential to do 10cr sales a month in the near-term just from Karare alone. It recently also introduced a unique product category, Quinoa Puffs, to leverage the increasing demand and awareness around Quinoa based products. With lifestyle changes and growing health awareness, health-consciousness is gaining traction. Too Yumm! has done a great job in leveraging this shift to differentiate itself in the highly competitive snacking segment.

Too Yumm!’s products have been accepted well by its target consumers. Its products on Amazon have seen >3.5 ratings on average spanning across 470 reviews for a total of 9 product category-flavor combinations (Veggie Stix, Foxnuts, Multi-grain chips). In general, it has seen good acceptance from people preferring spicy food. People have also appreciated its healthier ingredients relative to peer products as well as its packaging. Biggest complaint against the product has been on the spice level as people preferring mild spices find it too spicy for their taste. The other 5 product category-flavor combinations (Quinoa Puffs, Karare) that have been launched only recently have limited reviews, although positive, suggesting good traction so far.

While the management claims to have launched 5 flavors for each of its 5 product categories, in our channel checks we came across the below variants:

| Product Category | Flavors | ||

|---|---|---|---|

| Veggie Stix/Soya Stix | Cheese and Herbs | Sour Cream and Onion | Chilly Chataka |

| Foxnuts | Tandoori | Chatpata Masala | Home-Style |

| Multi-grain Chips | Dahi Papdi Chaat | Chinese Hot & Sour | Tangy Tomato |

| Quinoa Puffs | Khatta Meeta | Tikka Masala | |

| Karare | Noodle Masala | Chili Achari | Munchy Masala |

Health Benefits: Too Yumm! products have walked the talk when it comes to the health factor. There are a few health benefits that clearly stand out relative to peers:

- Baked not fried reduces the fat level, especially trans-fat which is associated with an increased risk of many diseases, including heart disease, cancer, diabetes and obesity

- Use of sunflower oil which is considered more healthy vs palm oil which is widely used by peers. Palm oil contains ∼49% saturated fat, a relatively high concentration compared with other vegetable oils which induce a larger increase in concentrations of total cholesterol and low-density lipoproteins. On the other hand, sunflower oil, a highly unsaturated vegetable oil, has been shown to be well-metabolized in liver. (Source: https://bit.ly/2XsIkUw)

- No Maida: Use of wheat flour, rice flour, corn flour as opposed to white/refined flour (maida). Maida induces digestion issues, increases sugar and bad cholesterol and is one of the key reasons why it is advised to stay away from junk food. (Source: https://bit.ly/2uCbSxy)

Use of healthy and nutritious ingredients such as ragi, soya, gram flour, sooji, oats and quinoa as shown below.

![ingredients]()

CESC Ventures also owns 70% stake in Gujarat based Apricot Foods that owns eVita brand catering to mass market segment. The idea behind acquiring this brand was to have a mass market presence with products across traditional namkeen and western snacks category to complement the mid-premium and niche focused Too Yumm! brand. CESC Ventures also plans to have a presence in the premium organic category either through in-house development or through a strategic tuck-in acquisition in the future.

Distribution: Within a short span of time, CESC Ventures has done a great job in expanding its FMCG distribution. Its distribution network today spans across 3.7 lakh outlets (inclusive of Apricot Foods) spread across 265 towns and cities. Currently, CESC Ventures’ distribution channel is more prominent in metro and tier-1 cities given the upscale and mid-premium nature of its product. Also, Metro and Tier-1 cities contribute 45% of snacking consumption (source: Nielsen) and thus are unavoidable on distribution front. However, going forward, CESC Ventures is keen on expanding to tier II and beyond cities. In line with this, management's focus is on introducing lower price points (INR 5 price point which is critical in snacking) and realigning the marketing campaigns and communication strategy to the realities of these markets. As a pilot project, it also exported to countries such as Singapore, Dubai and Oman and participated in some of the food events in the Gulf. Through its acquisition of Gujarat-based Apricot Foods (owner of eVita brand), the firm has further expanded its distribution and manufacturing presence in Western and Southern part of the country. Given eVita’s mass market appeal, it will enable the company to expand company’s distribution into tier 2 cities and beyond. This is while eVita brand can leverage Too Yumm!’s existing pan-India distribution to grow its sales, allowing CESC Ventures’ to milk its distribution channel more effectively. Despite its healthy progress, CESC Ventures has a long way to go. Its closest competitor, Prataap Snacks’ distribution spans across 17 lakh outlets vs 3.7 lakh outlets for CESC Ventures.

Manufacturing: The company has expanded its manufacturing facilities quickly to a total of 8 units through a combination of contract manufacturing and dedicated third-party facilities. Its manufacturing facilities are now spread across India serving zonal regions and providing ample capacity to serve the growing demand.

Profitability: While the FMCG business is currently loss-making, management is targeting a breakeven from the Too Yumm! brands by Q2 FY20.

Future Growth Plans: Overall market size in India for western snacks is estimated to be 20,000cr. Management plans to capture 10% of the market share and with the launch of Karare (Kurkure like - which is one of the biggest sub-segments in the Western snacks category), management is headed in the right direction. Guiltfree Industries already has 2% market share in the Western Snacks category as per management. It is also looking to venture into the super-premium segment (priced at INR 70-80 per packet) through organic snacks products either via an acquisition or in-house development. Longer-term plan for the FMCG business is to clock 10,000cr+ revenue. This is likely to be achieved through a combination of organic and inorganic acquisitions. CESC Ventures has plans to foray into personal care and Ayurveda segments. Its recent acquisition of an Ayurveda player, Dr Vaidya’s that has 90+ US FDA approved products, seems to be a step in this direction.

Firstsource Solutions

Firstsource Solutions is a well-recognized BPO player with marquee clients globally. Its client base includes the likes of global media houses like Sky, Comcast, five of top 10 health insurance companies, one of the top 10 US telecom companies, six of top 10 credit card issuers, one of the largest retail banks and mortgage lenders in US as well as one of the largest independent loan servicers in US.

Within business process outsourcing industry, tremendous shifts have happened over the past few years. With the fast-paced change in technology, the KPIs for outsourcing have moved away from cost-based effectiveness towards new-generation metrics such as domain expertise, innovation and digital know-how, right-shoring and value-added data analytics services. Firstsource has done well in adapting to these shifts and is continuously enhancing its value proposition to accelerate growth.

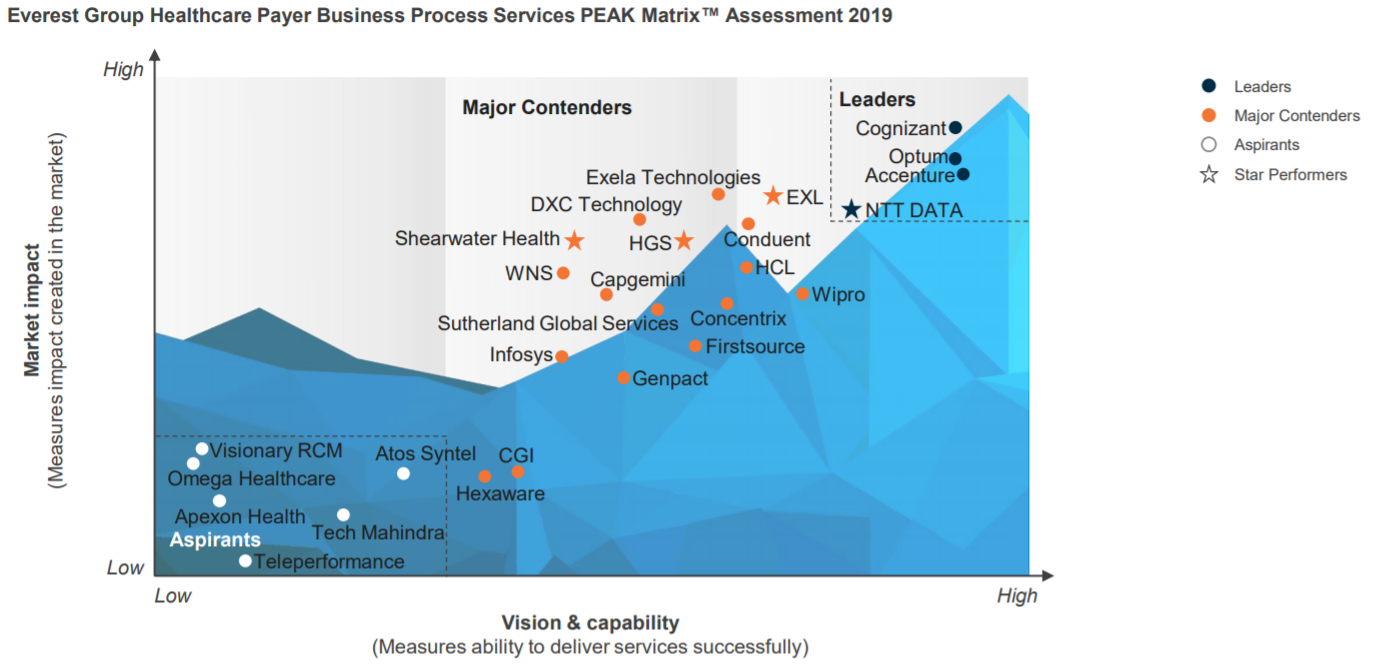

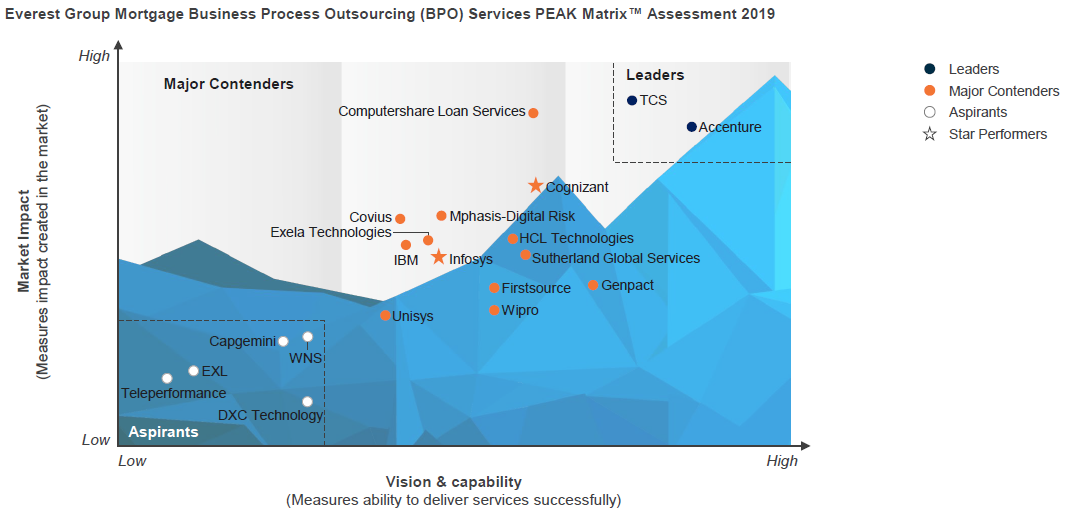

Domain Expertise: BPO industry is becoming more and more specialized. Even traditional offerings such as Finance & Accounting which were once taken for granted as horizontal offerings are becoming vertical specific as customers demand more in the need to be agile and efficient. Domain expertise is the way forward for any BPO company to sustain and grow. Firstsource has been always focused on domain expertise. Its key focus areas have been BFSI, Healthcare and Telecom. Industry consultant, Everest Group, recognizes Firstsource as a major contender globally (in the Everest Group Peak Matrix analysis shown below) across its focused domains within BFSI and Healthcare domains. Within Telecom & Media, Firstsource is recognized as a leader, the highest rank category, as per NelsonHall, a leading BPO industry consultant. Finding a place on the matrix of these consultants is a commendable achievement, given the highly competitive nature of the global BPO industry. Being recognized as a major contender and a leader further speaks well of Firstsource’s ability to access and execute large projects. Firstsource ranks high on vision and capability and has room to leverage this to improve its market impact with an aggressive sales force that the firm is currently in process of ramping up.

Recently, Firstsource has also added a new vertical – energy and utilities – by onboarding UK’s leading power and gas company. Company has also added mortgage servicing capabilities recently which tend to less sensitive to economic cycles to complement its existing, more cyclical in nature, mortgage origination capabilities.

Innovation and Digital Know-how: Moat for any BPO company is its customer relationship and the customer interaction/process implementation data it generates over time. This results in high switching costs for the customer. With the advent of Big Data, Artificial Intelligence (AI) and Machine Learning (ML), this moat is becoming even wider and deeper. BPO companies are now able to leverage this data and apply technologies like AI, ML to provide predictive analytics, step-change improvements in workflow optimization, automation as well as exponential reduction in turnaround times, frauds and errors. FirstSource with its strong stable of proprietary products, as below, has been progressing well on this front:

- FirstCustomerIntelligence: Provides real-time analysis of customer inputs – sentiment, emotions and behaviour - across multiple communication and feedback channels including voice, text, social media, etc.

- Sympraxis: Proprietary workflow and case management solution used for reducing manual dependence and increase digitization and automation of processes including documentation, automated monitoring and measuring of key events and triggers

- NPS Predictor Model: Predictive modeling tool that uses advanced speech analytics for better customer conversion and satisfaction

- FirstSmartomation: Automation tool that uses non-invasive technology to integrate diverse applications on client’s native platforms shortening transaction processing time

Right-shoring: Right-shoring is a critical element for any BPO company to win large and profitable contracts. In this digital world, security, IP protection, right vernacular support and trust are key factors. Firstsource with its large onshore presence and wide geographical reach with offices across UK, US, Philippines and India, has a strong strategic advantage over many of its peers in winning large contracts. Right-shoring allows flexibility to the client in providing a mix of high-end premium services through onshore support while benefitting from offshoring low-end repetitive tasks at a cheaper price.

Prudent Capital Allocation: Firstsource’s management has been prudent at capital allocation. Since 2013, when the new ownership took over, Firstsource has been pruning unnecessary resources and businesses with a focus on improving efficiency and profitability, while keeping an eye on growth. Along these lines, in FY18, the company disposed its domestic business that was not yielding value to focus solely on the healthy FCF generating exports business. The company has also been very prudent in using the excess cash flows towards reduction of debt and starting FY18 also rewarded shareholders with dividends, a first in the company’s history.

Valuation: While Firstsource is not a high growth business, it is essentially a cash cow for CESC ventures with its steady business model and a sticky client base. Adjusting for domestic business disposition, growth was reasonable at >7% in FY18 in constant currency terms. According to market reports, the global BPM market size is expected to grow at a CAGR of 10-12% over the period of 2017 – 2022 and is expected to reach $18 billion by 2022. Assuming conservative estimates of 5% growth and 13-14% ROE in our DCF, Firstsource Solutions can be fairly valued at an exit multiple of 8-9x PE over a four-year horizon, suggesting a valuation of INR 3900cr as per our DCF analysis. Management is targeting to grow its operating margins from current 14% levels to industry-standard 17-18% levels. If this happens, valuations can see further upside from our projections.

Kolkata Mall

CESC Ventures owns an upscale luxury mall in Kolkata named Quest Mall, as in the below picture. It launched in November 2013 and since has been a huge success. During FY19, it saw annual footfalls of over 1.6cr and its retailer tenants saw combined gross sale of about INR 700cr. Outlook India featured Quest mall among top 5 luxury malls in India for luxury shopping (https://bit.ly/2LB9BwD). For those curious to explore the mall, try this virtual tour option: https://bit.ly/2YwNlYC.

Source: Treebo.com (https://bit.ly/2XlIkFM)

Source: Treebo.com (https://bit.ly/2XlIkFM)

Quest Mall’s moat is its 1) Location and 2) Network effect from High-end and Sticky Client Base:

- Location: The mall is located at the heart of the Kolkata city and is close to premium residential areas like Ballygunge and Park Street, with easy access from Alipore & New Alipore via a flyover.

- Network effect from High-end and Sticky Tenant Base: Quest Mall showcases some of the best lifestyle and fashion brands such as Gucci, Burberry, Calvin Klein, Breitling, Canali, Boss, Aeropostale, Michael Kors, Coach, Jimmy Choo, Armani Exchange, Estee Lauder, Hugo Boss, Lacoste, Rolex, etc. No other mall in Kolkata boasts of a long list of such high-end brands which suggests that it is almost a monopoly in the super-luxury segment. It has a good mix of fine dining options such as Bombay Brasserie, Aajisai (high-end Japanese cuisine), The Irish House which is complemented by a large food court housing fast-food chains like Chili’s, Pizza Hut, KFC, etc. With presence of movie theater, Inox, apparel store, Lifestyle, supermarket, Spencers Retail, and a bookstore chain, Starmark, Quest mall provides ample avenues for shopping and entertainment attracting large number footfalls to the mall. Most of the tenants have been with the mall since the early days. Presence of high-quality tenants drive footfalls which in turn drive the value proposition for the tenants creating a positive network effect. Based on our channel checks, visitors and customers have positive experiences visiting the Quest mall as also indicated by the reviews for the mall on TripAdvisor (https://bit.ly/2JqvDzI).

Valuation: Going by recent mall transactions as in the table below, the Quest mall can be valued conservatively today at INR 10,000 per sq ft (implying INR 11,700 per sq. ft. 4 years from now assuming conservative growth of 4%). This suggests total enterprise value of the mall to be about 485cr by FY23. With 135cr of net debt (note that debt level has been coming down continuously, but we are making a conservative assumption that the net debt will stay the same in FY23), the equity value of the mall can be valued at 350cr.

| Mall Name | Location | Leasable Area (sq ft) |

Transaction Value (cr) |

Implied Value (per sq ft) |

As of Date |

|---|---|---|---|---|---|

| Noida Mall | Noida, NCR | 2,000,000 | 2950 | 14750 | May 3 2019 |

| Palava Mall | Thane, Mumbai | 500,000 | 650 | 13000 | Dec 16 2017 |

| Westend Mall | Aundh, Pune | 370,000 | 400 | 10811 | Oct 20 2016 |

| North Country Mall | Mohali | 1,000,000 | 700 | 7000 | May 2 2017 |

Note that our valuation assumptions are quite conservative relative to precedent mall transactions in India as in the table above. We have conservatively priced the mall below Westend mall and Palava mall, despite their tier-1 locations compared to metro location of Quest mall. On the other hand, since North Country Mall is based in Mohali, a tier-2 location, we have priced Quest mall higher than it. Also, most of these transactions occurred 2 years ago suggesting additional 8-10% upside cushion (assuming 4-5% inflation driven growth). Last but not the least, presence of exclusive luxury brands at Quest Mall provide further upside cushion to our valuation assumptions.

Other Businesses

Restaurants Business: This is a relatively new venture and is small in the current form with FY19 revenues of about 7cr. It operates restaurants under two key brands, “Waffle Wallah” and “Bombay Toasties”. “Waffle Wallah” caters to the dessert segment while “Bombay Toasties” is a quick service restaurant brand geared towards Indian comfort food.

Haldia Residential Project: This is a residential real estate project catering to large corporates and individuals in the port township of Haldia. The project is planned to be spread across 3.5 acres and is being executed in multiple phases. Phase 1 consisted of construction of 0.2mm sq ft saleable area of which 0.1mm sq ft has been completed and handed over during FY19. Remaining 0.1 mm sq ft is expected to be completed soon. Phase 2 construction is expected to begin in later part of FY20.

Standalone Entity: This is a software service provider to CESC’s power transmission and distribution business. It clocked operational revenue of INR 65-70cr and derived other income of over 60cr, largely coming from Firstsource’s dividend distribution and monetization of certain investments. With the corporate level overheads and operational expenses, profitability (PAT) ex other income is low at less than 5cr.

Key Factors to Watch

FMCG Business Execution: Our upside potential from CESC Ventures relies heavily on the execution of FMCG business. While this is a long-term effort, the company is out on an ambitious charter, in an extremely competitive space, and one needs to keep a tab on the milestones achieved on a regular basis to ensure execution is in line with expectations and is not spread too thin prematurely.

Non-core Activity: Given CESC Ventures is a holding company, there can be a propensity to divert excess cash flows to non-core businesses. One needs to keep a close watch on the cash flow movements to make sure that the management stays focused on the core business activities.

Reach Out to Us!

Please be free to contact us if you have any further queries.

Disclaimer: Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

We would appreciate your valuable feedback! Please leave us your comments below.